- A rapid rise in interest rates over the past month has led to volatility in the stock market, with high growth stocks tumbling as inflation fears persist.

- The tech-heavy Nasdaq 100 is off about 7% from its recent high, while the S&P 500 is down 3%.

- But one indicator that has historically marked a bottom in stocks just flashed again, according to Fundstrat’s Tom Lee.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

An indicator that has been historically accurate in marking a bottom in the stock market flashed again this week for the fourth time since 2012, according to a Thursday note from Fundstrat’s Tom Lee.

Volatility in the stock market spiked as a rapid rise in interest rates derailed high growth stocks. The Nasdaq 100 is off 7% from its February 16 high, while the S&P 500 is down 3% over that same time period.

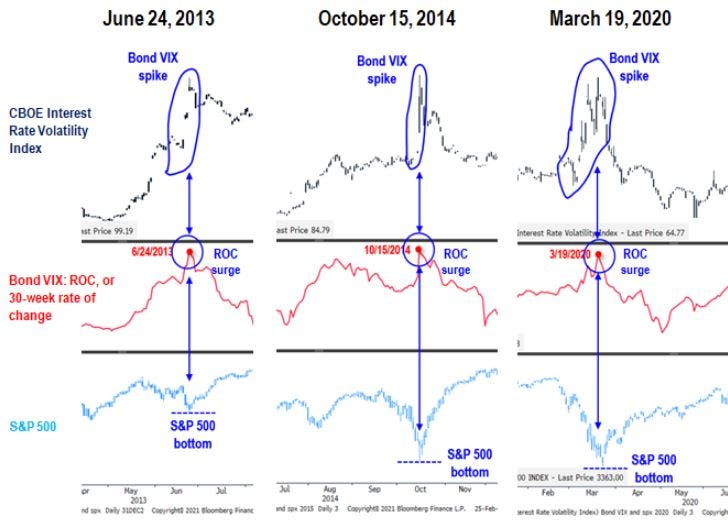

The 10-year US Treasury note spiked to a cycle high of more than 1.50% on Thursday, and interest rate volatility saw its biggest spike since March of 2020, as measured by the CBOE Interest Rate Volatility Index.

But according to Lee, the volatility in interest rates feels “capitulatory,” which could lead to gains ahead for stocks.

Lee highlighted that soaring interest rate volatility, coupled with an extended 30-week rate of change, occured on the following dates: June 24, 2013, October 15, 2014, March 19, 2020, and February 24, 2021.

What's significant about the first three of these dates is that after each of these instances it marked the bottom in the stock market "to the day," Lee said.

But just because the indicator marked the bottom in stocks during the past 3 instances, "this does not mean it has to happen a 4th time," Lee warned.

To take advantage of a potential bottom in the market, Lee recommends investors increase their exposure to cyclical stocks that will benefit from a continued reopening of the economy.